Breaking News PM Youth Loan Scheme 2025 – Apply Online & Get Up to Rs. 7.5 Million for Your Business

PM Youth Loan Scheme

The PM Youth Loan Scheme 2025 is a flagship initiative by the Government of Pakistan designed to empower the country’s youth through financial support. This program provides easy access to low-interest and interest-free loans, enabling young entrepreneurs to start or scale their businesses. Whether your venture is in agriculture, technology, retail, or freelancing, this scheme offers a practical way to turn your business idea into reality.In this comprehensive guide, we cover the eligibility criteria, loan categories, application process, benefits, and tips for approval so you can confidently apply for funding and kickstart your entrepreneurial journey.

Overview of the PM Youth Loan Scheme 2025

The Prime Minister Youth Business & Agriculture Loan Scheme 2025 aims to promote self-employment and entrepreneurship among young Pakistanis. By providing financial assistance, it encourages job creation, reduces youth unemployment, and strengthens Pakistan’s small business ecosystem.

The program targets a wide range of sectors, including:

- Agriculture and livestock

- IT startups and e-commerce

- Retail and manufacturing

- Freelancing and digital services

This initiative is ideal for both urban and rural entrepreneurs seeking financial support for business expansion or startup funding.

Eligibility Criteria

Eligibility is straightforward, ensuring that most young Pakistanis can benefit.

- Age: 21–45 years (18+ for IT, e-commerce, and freelancing ventures)

- Nationality: Pakistani citizen with a valid CNIC

- Business: Must be a registered startup, ongoing business, or agriculture project

- Location: Urban or rural areas of Pakistan

| Criteria | Details |

| Age Limit | 21–45 years (18+ for IT/e-commerce) |

| Nationality | Pakistani citizen with CNIC |

| Loan Categories | Tier 1: ≤0.5M, Tier 2: 0.5–1.5M, Tier 3: 1.5–7.5M |

| Interest Rates | Tier 1: 0%, Tier 2: 5%, Tier 3: 7% |

| Repayment Period | Up to 8 years |

| Target Sectors | Agriculture, IT, e-commerce, retail, manufacturing, freelancing |

Loan Categories, Markup Rates, and Repayment

The PM Youth Loan Scheme 2025 is divided into three tiers based on business size and funding requirements:

- Tier 1: Up to Rs. 0.5 million – Interest-free, ideal for micro startups

- Tier 2: Rs. 0.5–1.5 million – 5% markup, suitable for small growing businesses

- Tier 3: Rs. 1.5–7.5 million – 7% markup, for established or larger businesses

Repayment period: Up to 8 years, allowing entrepreneurs ample time to stabilize and scale operations.

How to Apply Online

Applying for the PM Youth Loan is fully digital, fast, and transparent. Follow these steps to ensure a smooth application process:

- Visit the official portal: https://pmybals.pmyp.gov.pk/

- Click “Apply for Loan” and enter your CNIC number with its issue date

- Select your desired loan tier based on your business requirements

- Complete your personal and business information accurately

- Upload necessary documents such as CNIC, bank account details, and business plan

- Submit the application and save your tracking ID to monitor approval status

Upon approval, funds are disbursed through partner banks, providing quick access to capital for your venture.

Key Benefits of the PM Youth Loan Scheme

This program offers more than just financing—it provides a path toward long-term financial independence.

- Interest-free loans for micro startups

- Low markup rates for medium and large businesses

- Long repayment period of up to 8 years

- Digital application process ensures transparency and speed

- Special focus on women entrepreneurs and freelancers

With these benefits, the scheme empowers young Pakistanis to build sustainable businesses and contribute to the economy.

Tips to Improve Loan Approval Chances

- Prepare a professional business plan – include detailed costs, projected revenue, and business goals.

- Ensure accuracy – match all personal and financial details with official documents.

- Demonstrate innovation – banks prefer applications that create jobs, promote technology adoption, or strengthen the agricultural sector.

- Highlight growth potential – clear revenue projections and market research can make your application stand out.

Why 2025 is Perfect for Digital and Agriculture Startups

The scheme emphasizes sectors with high growth potential, such as IT, freelancing, e-commerce, and agriculture. Modern digital tools and technology adoption in farming are strongly encouraged, reflecting Pakistan’s vision for a robust digital economy and productive agriculture sector.

Frequently Asked Questions (FAQs)

Q1: Who can apply for the PM Youth Loan 2025?

Any Pakistani citizen aged 21–45 can apply. For IT and e-commerce businesses, the minimum age is 18.

Q2: What is the maximum loan amount?

Up to Rs. 7.5 million, depending on your business plan and tier selection.

Q3: Are the loans interest-free?

Tier 1 loans (≤0.5M) are interest-free. Tiers 2 and 3 have 5% and 7% markup rates, respectively.

Final Word

The PM Youth Loan Scheme 2025 is more than financial support—it’s a nationwide initiative to create entrepreneurs who can drive Pakistan’s economy forward. With easy eligibility, low markup rates, and a user-friendly online process, now is the perfect time for young Pakistanis to transform their business ideas into thriving ventures.

Latest Updates

Honda Ridgeline 2026 Revealed rate: Bold New Design, Power Boost & Everyday Comfort for US Drivers

Honda Ridgeline 2026 Revealed rate: Bold New Design, Power Boost & Everyday Comfort for US Drivers PSER Eligibility Check 2026 by CNIC on PSER Punjab Gov Pk

PSER Eligibility Check 2026 by CNIC on PSER Punjab Gov Pk 8070 PSER Ramzan Relief 2026 – Ineligibility Reasons, Eligibility Rules & Re-Verification Process

8070 PSER Ramzan Relief 2026 – Ineligibility Reasons, Eligibility Rules & Re-Verification Process BISP 8171 Check by SMS 2026 New Registration Method and CNIC Verification Guide

BISP 8171 Check by SMS 2026 New Registration Method and CNIC Verification Guide Big News: 8070 Ramzan Relief Package 2026: How to Check Eligibility for Free Ration & 10,000 Cash.

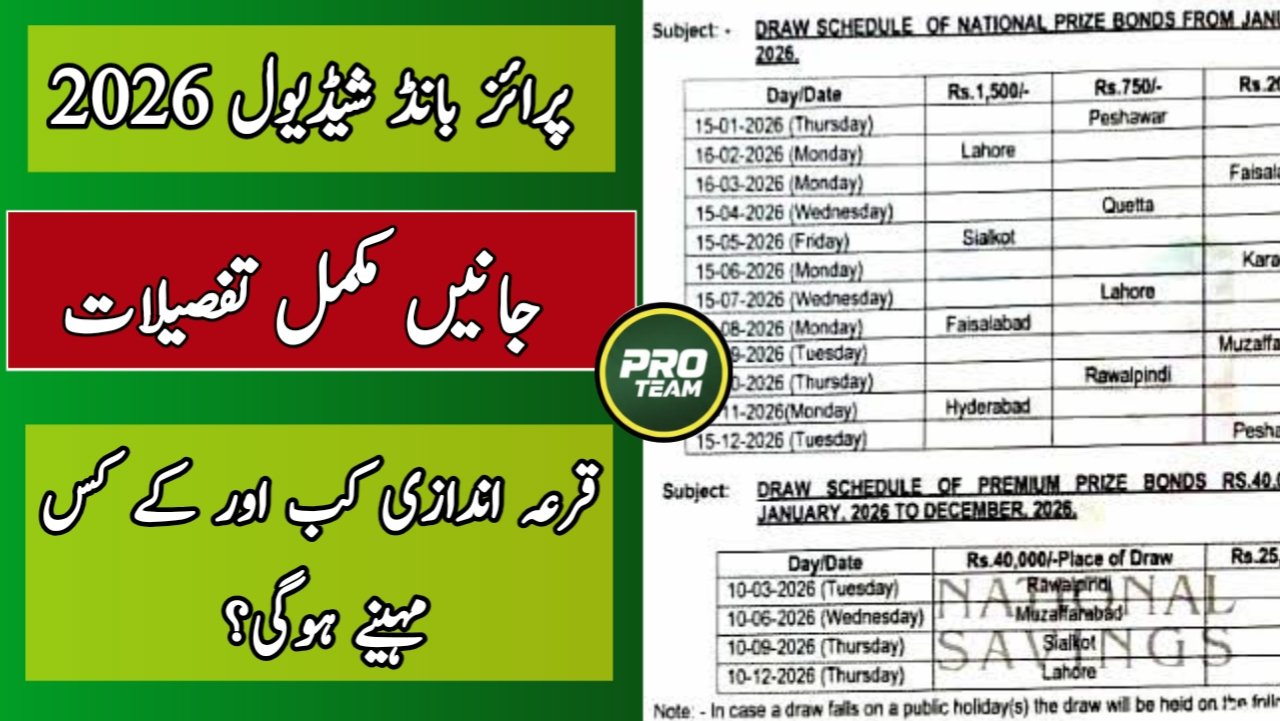

Big News: 8070 Ramzan Relief Package 2026: How to Check Eligibility for Free Ration & 10,000 Cash. Breaking News: Prize Bond Draw Schedule 2026 – Complete Guide for All Denominations

Breaking News: Prize Bond Draw Schedule 2026 – Complete Guide for All Denominations