Benazir Khushal Karobar Scheme 2026: Eligibility, Loan Details, and How to Apply

The Benazir Khushal Karobar Scheme is a special loan program launched through Sindh Bank to help small business owners and entrepreneurs across Sindh. This scheme mainly supports people whose businesses suffered losses during the COVID-19 pandemic. It provides financial help so entrepreneurs can restart, stabilize, and grow their businesses again.

The scheme focuses on fairness and transparency, and eligible applicants are selected through a balloting system. It is especially useful for shop owners, traders, service providers, and small manufacturers who need financial support but meet strict banking criteria.

| Feature | Details |

| Loan Provider | Sindh Bank |

| Target Group | Small business owners |

| Province | Sindh |

| Age Limit | 22 to 55 years |

| Business Type | Existing businesses only |

| Credit Status | Clean FCIB required |

| Selection Method | Balloting |

| Collateral | Property valuation required |

Benazir Khushal Karobar Scheme Overview

The Benazir Khushal Karobar Scheme loan is designed to revive small businesses that were already operating before COVID-19. This scheme is not meant for new startups. Instead, it supports existing businesses that faced financial difficulties during lockdowns and economic slowdown.

Key highlights of the scheme include:

- Financial support through bank loans

- Transparent selection through balloting

- Focus on business recovery and sustainability

- Preference for small and medium enterprises in Sindh

- Strict financial and credit background checks

Applicants must carefully read the eligibility rules before applying to avoid rejection during the screening or balloting process.

Eligibility Criteria for Benazir Khushal Karobar Scheme Loan

To qualify for the Benazir Khushal Karobar Scheme, applicants must fulfill all eligibility conditions. These conditions ensure that loans go to deserving and financially responsible individuals.

Eligibility requirements include:

- Permanent residency in Sindh Province

- An existing business located in Sindh

- Business must have been negatively affected by COVID-19

- Age between 22 and 55 years

- Applicant must not be a government or semi-government employee

- Clean FCIB credit report with no loan defaults

- No active loan from:

- Any bank

- Development Finance Institution (DFI)

- Ehsaas Program

- Any similar financial scheme

Failure to meet even one condition may lead to disqualification.

Required Documents for Sindh Bank Business Loan

Applicants who are selected through balloting must submit complete documentation for final loan approval. Missing documents can delay or cancel the loan process.

Required documents include:

- Projected financial statements

- Cash flow estimates for the next three years

- Repayment plan showing loan sustainability

- Net worth statement

- For individuals or partnership firms

- Formal request letter

- Clearly explaining the purpose of the loan

- Collateral documents

- Property valuation from a bank-approved valuator

- Business registration documents

- Registered Partnership Deed (if applicable)

- CNIC copies of all partners

All documents must be accurate and verifiable.

Application Process for Benazir Khushal Karobar Scheme

The application process is simple but requires attention to detail. Interested applicants can apply through Sindh Bank using official channels only.

Steps to apply include:

- Download application form from the Sindh Bank official website

- Or collect the form from any Sindh Bank branch

- Fill in complete and correct business details

- Attach required documents

- Submit the application before the announced deadline

- Wait for the balloting process

- Successful candidates are contacted for further processing

For official updates and forms, visit:

👉 https://www.sindhbank.com.pk

Micro Loan Option for Small Entrepreneurs in Sindh

For individuals running very small businesses, the Sindh Microfinance Bank Karobar Loan is another helpful option. This loan is suitable for traders and service providers who need a smaller amount of financing.

Key features of this micro loan include:

- Loan amount ranging from PKR 42,500 to PKR 150,000

- Suitable for micro-entrepreneurs

- Focus on trade and service businesses

- Easier requirements compared to commercial bank loans

This option is ideal for vendors, small shopkeepers, and home-based business owners.

Benefits of Benazir Khushal Karobar Scheme

The Benazir Khushal Karobar Scheme offers several long-term benefits for small business owners in Sindh.

Main benefits include:

- Access to formal banking finance

- Opportunity to rebuild businesses after COVID-19 losses

- Transparent and fair selection process

- Encouragement for entrepreneurship in Sindh

- Financial discipline through structured repayment plans

This scheme plays an important role in improving economic activity at the grassroots level.

Conclusion

The Benazir Khushal Karobar Scheme is a valuable initiative by Sindh Bank to support small business owners affected by COVID-19. With clear eligibility rules, a fair balloting process, and structured documentation requirements, the scheme helps deserving entrepreneurs regain financial stability. For those with very small businesses, microfinance loan options are also available. Overall, this program strengthens small enterprises and contributes to economic recovery in Sindh.

FAQs

Q1: Can I apply if I want to start a new business?

No, the scheme is only for existing businesses that were affected by COVID-19.

Q2: Is collateral mandatory for this loan?

Yes, applicants must provide property valuation as collateral through a bank-approved valuator.

Q3: How are applicants selected for the scheme?

Eligible applicants are selected through a formal balloting process conducted by Sindh Bank.

Q4: Can I apply if I already have a loan from another bank?

No, applicants must not be availing any loan from banks, DFIs, or government schemes.

Latest Updates

Honda Ridgeline 2026 Revealed rate: Bold New Design, Power Boost & Everyday Comfort for US Drivers

Honda Ridgeline 2026 Revealed rate: Bold New Design, Power Boost & Everyday Comfort for US Drivers PSER Eligibility Check 2026 by CNIC on PSER Punjab Gov Pk

PSER Eligibility Check 2026 by CNIC on PSER Punjab Gov Pk 8070 PSER Ramzan Relief 2026 – Ineligibility Reasons, Eligibility Rules & Re-Verification Process

8070 PSER Ramzan Relief 2026 – Ineligibility Reasons, Eligibility Rules & Re-Verification Process BISP 8171 Check by SMS 2026 New Registration Method and CNIC Verification Guide

BISP 8171 Check by SMS 2026 New Registration Method and CNIC Verification Guide Big News: 8070 Ramzan Relief Package 2026: How to Check Eligibility for Free Ration & 10,000 Cash.

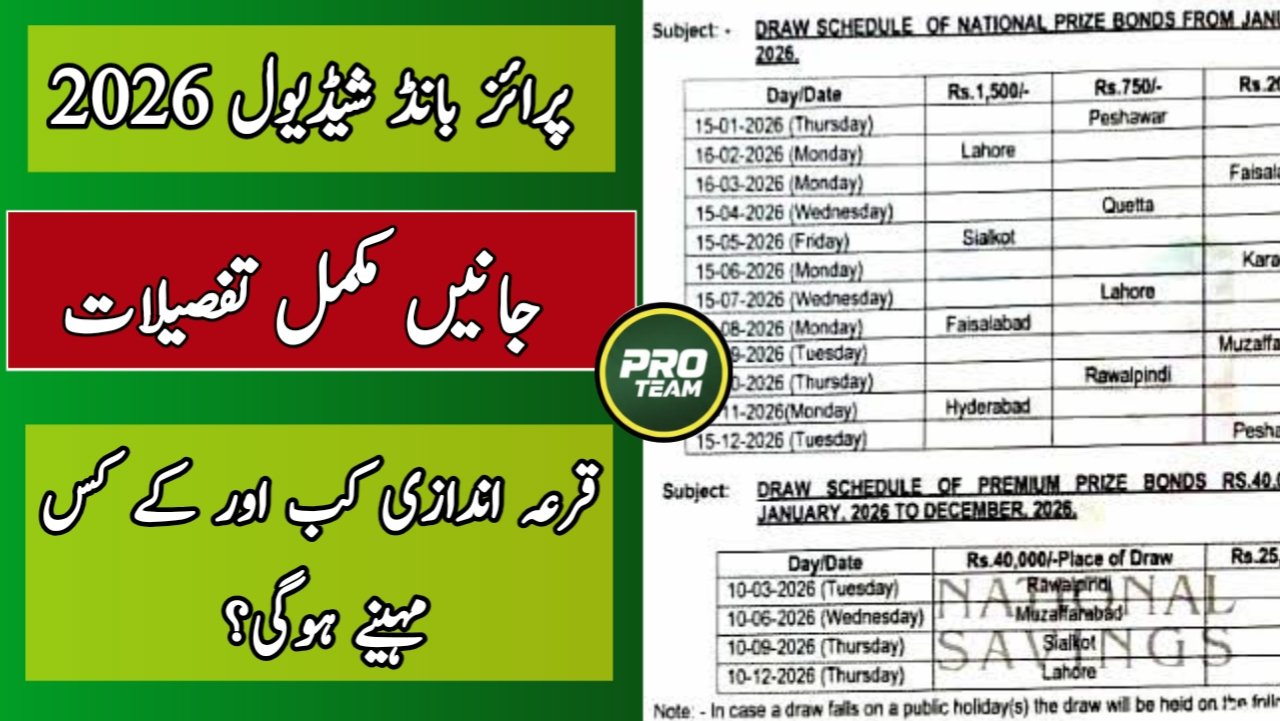

Big News: 8070 Ramzan Relief Package 2026: How to Check Eligibility for Free Ration & 10,000 Cash. Breaking News: Prize Bond Draw Schedule 2026 – Complete Guide for All Denominations

Breaking News: Prize Bond Draw Schedule 2026 – Complete Guide for All Denominations