PM Youth Loan Scheme Distribution Date Announced 2026 – Latest Update

The Prime Minister’s Youth Business and Agriculture Loan Scheme (PM Youth Loan Scheme) is one of Pakistan’s largest programs aimed at supporting young entrepreneurs and farmers. The scheme is active for the 2026 cycle, and applications are currently being accepted from eligible candidates across the country.

Many applicants are searching for the PM Youth Loan Scheme distribution date. As of early February 2026, the government has not announced a single nationwide distribution date. Instead, loan amounts are distributed after individual application approval by partner banks. This means each applicant may receive funds on a different date, depending on the processing and verification timeline.

The scheme offers loans on easy terms to help youth start or expand businesses and agricultural activities.

| Feature | Details |

|---|---|

| Scheme Name | PM Youth Business & Agriculture Loan Scheme |

| Year | 2026 |

| Loan Amount | PKR 0.5 million to PKR 7.5 million |

| Loan Type | Business and Agriculture |

| Processing Time | Up to 45 days |

| Disbursement | Through partner banks |

| Application Mode | Online |

| Target Group | Youth entrepreneurs and farmers |

PM Youth Loan Scheme Distribution Date Explained

The PM Youth Loan Scheme does not follow a single distribution date for all applicants. Instead, loan disbursement depends on when an application is approved by the bank.

Key points about the distribution date include:

- No single nationwide loan distribution date is announced

- Applications are processed throughout the year

- Loan funds are released after bank approval

- Each applicant receives funds on a different date

- Disbursement depends on document verification

- Banks inform applicants directly about approval

Applicants are advised not to rely on unofficial dates shared on social media.

Application Process for PM Youth Loan Scheme 2026

The application process for the PM Youth Loan Scheme is fully online and designed to be simple and transparent. Applicants must submit their information through the official portal.

The application steps include:

- Online registration through the Digital Youth Hub

- Filling out personal and business details

- Submission of CNIC and contact information

- Uploading business or agriculture plan

- Selection of preferred bank

- Final submission of the application

Once submitted, the application is forwarded to the selected bank for review.

Processing Time and Loan Approval Timeline

After submitting the application, applicants often want to know how long approval will take. According to official guidelines, the processing time does not exceed 45 days.

The processing stage includes:

- Initial screening of application data

- Verification of CNIC through NADRA

- Review of business or agriculture plan

- Credit and background checks

- Bank interview (if required)

- Final approval or rejection decision

Applicants can track their application status online during this period.

Loan Disbursement Through Partner Banks

Once an application is approved, the loan amount is disbursed by participating banks. These include commercial, Islamic, and SME banks across Pakistan.

Important details about loan disbursement are:

- Funds are released directly by the bank

- Disbursement date varies by applicant

- Loan amount depends on approved category

- Repayment schedule is shared by the bank

- Funds are credited to the applicant’s account

- Applicants are informed via call or SMS

There is no central ceremony for loan distribution, unlike other government schemes.

For official applications and status tracking, visit the Digital Youth Hub:

https://pmybals.pmyp.gov.pk

Difference Between Youth Loan Scheme and Laptop Scheme

Many people confuse the PM Youth Loan Scheme with the Prime Minister’s Youth Laptop Scheme. These are two separate programs.

Key differences include:

- Youth Loan Scheme provides financial loans

- Laptop Scheme distributes laptops to students

- Loan scheme runs year-round

- Laptop Scheme Phase-IV had events in January 2026

- Loan distribution is bank-based

- Laptop distribution is event-based

Applicants should apply only to the program that matches their eligibility.

Conclusion

The PM Youth Loan Scheme 2026 is fully active, and applications are being processed across Pakistan. While no single distribution date has been announced, approved applicants receive their loan amounts after bank verification and approval, usually within 45 days. The scheme provides a valuable opportunity for young entrepreneurs and farmers to access affordable financing. Applicants should regularly check their application status through official channels for accurate updates.

FAQs

1. Has the PM Youth Loan Scheme distribution date been announced?

No, there is no single nationwide distribution date. Loans are disbursed after individual approval.

2. How long does it take to receive the loan after applying?

The processing time is up to 45 days, depending on bank verification.

3. Where can I apply for the PM Youth Loan Scheme?

Applications are submitted online through the Digital Youth Hub portal.

4. How will I know my loan is approved?

The bank will inform you directly through call, SMS, or portal updates.

Latest Updates

Honda Ridgeline 2026 Revealed rate: Bold New Design, Power Boost & Everyday Comfort for US Drivers

Honda Ridgeline 2026 Revealed rate: Bold New Design, Power Boost & Everyday Comfort for US Drivers PSER Eligibility Check 2026 by CNIC on PSER Punjab Gov Pk

PSER Eligibility Check 2026 by CNIC on PSER Punjab Gov Pk 8070 PSER Ramzan Relief 2026 – Ineligibility Reasons, Eligibility Rules & Re-Verification Process

8070 PSER Ramzan Relief 2026 – Ineligibility Reasons, Eligibility Rules & Re-Verification Process BISP 8171 Check by SMS 2026 New Registration Method and CNIC Verification Guide

BISP 8171 Check by SMS 2026 New Registration Method and CNIC Verification Guide Big News: 8070 Ramzan Relief Package 2026: How to Check Eligibility for Free Ration & 10,000 Cash.

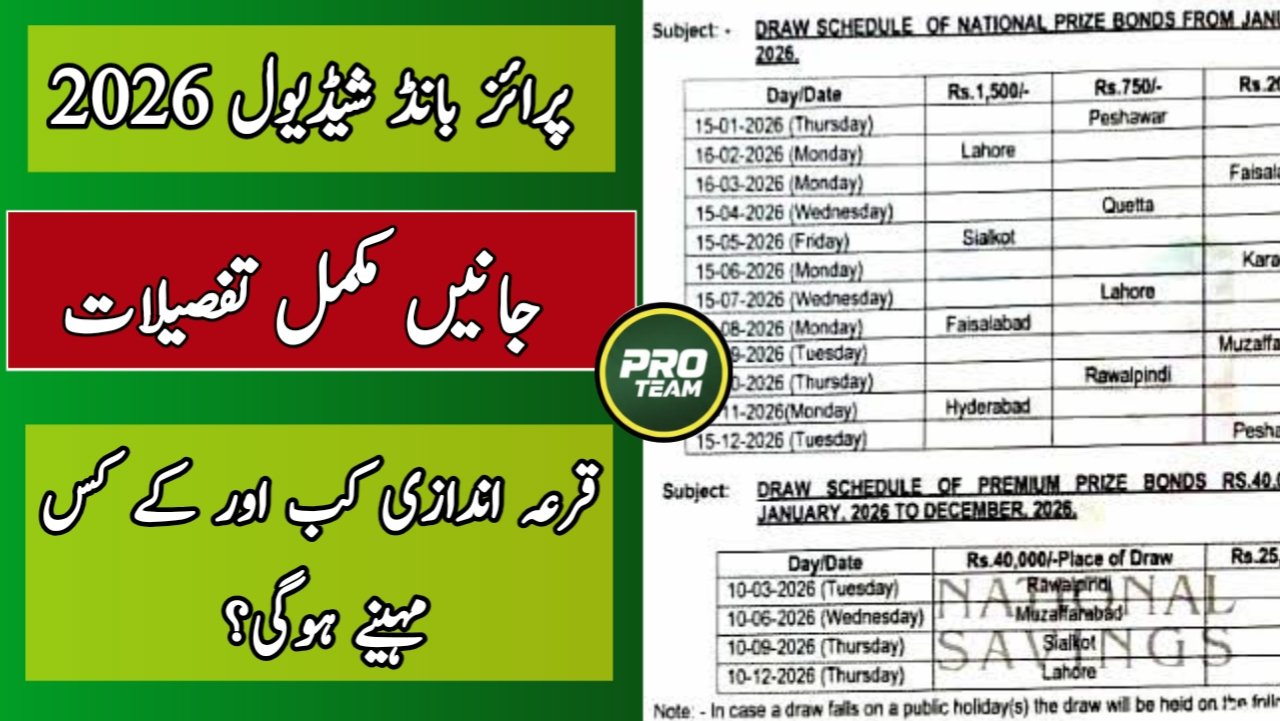

Big News: 8070 Ramzan Relief Package 2026: How to Check Eligibility for Free Ration & 10,000 Cash. Breaking News: Prize Bond Draw Schedule 2026 – Complete Guide for All Denominations

Breaking News: Prize Bond Draw Schedule 2026 – Complete Guide for All Denominations