Latest Update Apply Online for PM Youth Business Loan 2025 – Requirements Process & Approval Timeline

PM Youth Business Loan

The Government of Pakistan has reopened the PM Youth Business Loan & Agriculture Loan Scheme 2025, offering young entrepreneurs and farmers a golden opportunity to start or expand their businesses. This initiative provides interest-free or low-interest loans, a hassle-free online application process, and equal opportunities for both new and existing ventures. Whether you plan to launch a startup, upgrade your farming setup, or start a digital business, this comprehensive guide explains eligibility criteria, required documents, application procedure, and approval timeline in detail.

What is the PM Youth Business & Agriculture Loan Scheme 2025?

The PM Youth Loan Scheme 2025 is a government-led program aimed at reducing unemployment, promoting self-employment, and supporting small businesses nationwide. The program offers financial assistance through three structured loan tiers, making it easier for individuals to fund their business or farming projects.

This scheme targets:

- New startups and small businesses

- Expansion of existing ventures

- Agriculture, livestock, and farming projects

- Freelancers, IT professionals, and digital enterprises

- Women, transgender applicants, and persons with disabilities

Its main goal is to stimulate entrepreneurship and economic growth by offering young citizens easy access to financing with minimal bureaucratic hurdles.

Key Features of PM Youth Loan Scheme 2025

The loan is available in three tiers, catering to various business sizes and financing needs:

| Tier | Loan Amount (PKR) | Interest/Profit Rate | Collateral Requirement |

| Tier 1 | Up to 500,000 | 0% interest | No collateral required |

| Tier 2 | 500,000 – 1.5 million | Low profit rate | As per bank requirement |

| Tier 3 | 1.5 – 7.5 million | Market-based rate | As per bank requirement |

Additional benefits include:

- Repayment period of up to 8 years

- 1-year grace period before repayment starts

- 10% equity requirement for new businesses

- 25% quota reserved for women applicants

- Open to citizens of Pakistan, AJK, and Gilgit-Baltistan

These features make it one of the most accessible and youth-friendly business loan programs in the country.

Eligibility Criteria for PM Youth Loan 2025

Applicants must meet the following requirements to qualify:

- Nationality: Pakistani citizen with valid CNIC

- Age Limit: 21–45 years (minimum 18 for IT and e-commerce applicants)

- Education: No strict requirement for Tier 1 loans

- Business Type:

- New startups

- Expansion of an existing business

- Agriculture or farming projects

- Skills/Experience: Relevant skills or prior experience improve approval chances

Documents Required for Online Application

Ensure you have the following documents scanned and ready for submission:

- CNIC (front and back)

- Passport-size photograph

- Bank account details

- Educational certificates (optional but recommended)

- Business plan or feasibility report

- Utility bill or rental agreement for address verification

Having all documents prepared in advance ensures a smooth and faster approval process.

Step-by-Step Process to Apply Online

- Visit the Official Website: Go to pmyp.gov.pk (avoid unofficial links).

- Select the Loan Scheme: Click on “Youth Business & Agriculture Loan Scheme 2025.”

- Start the Application: Enter CNIC number, CNIC issue date, mobile number, and verify via OTP.

- Fill the Form: Provide personal and business details, financial estimates, and expected income.

- Upload Documents: Attach clear scanned copies of all required documents.

- Review & Submit: Double-check information, agree to terms, and submit. You will receive a Tracking ID via SMS.

Approval Process and Timeline

Once submitted, your application goes through the following stages:

- Initial Screening

- Forwarding to Selected Bank

- Verification (bank may contact or visit applicants)

- Approval or Rejection

- Loan Agreement Signing

- Disbursement to your bank account

Approval Timeline: Most applications are processed within 30–60 days, depending on business type, loan tier, and document completeness.

How to Check Loan Status Online

To track your application:

- Visit pmyp.gov.pk

- Click on “Application Status Check”

- Enter your CNIC and Tracking ID

- View real-time updates

Tips to Increase Approval Chances

- Prepare a realistic and clear business plan

- Mention accurate costs and expected income

- Upload valid and legible documents

- Provide correct contact and address details

- Choose a loan tier based on actual financial needs

A practical and well-presented business idea significantly improves your approval chances.

Frequently Asked Questions (FAQ)

Q1: Can women apply for the PM Youth Loan 2025?

Yes, 25% of the quota is reserved exclusively for women applicants.

Q2: Is collateral required for Tier 1 loans?

No, Tier 1 loans up to PKR 500,000 are interest-free and require no collateral.

Q3: Can freelancers or digital businesses apply?

Yes, IT professionals, digital entrepreneurs, and freelancers are eligible under this scheme.

Final Word

The PM Youth Business & Agriculture Loan Scheme 2025 is a valuable opportunity for Pakistan’s youth to kickstart or expand their business ventures. With flexible repayment, interest-free financing options, and a fully online application process, it empowers young entrepreneurs to contribute to the nation’s economic growth. If you have a viable business idea and meet the eligibility criteria, applying for this loan is highly recommended.

Latest Updates

Honda Ridgeline 2026 Revealed rate: Bold New Design, Power Boost & Everyday Comfort for US Drivers

Honda Ridgeline 2026 Revealed rate: Bold New Design, Power Boost & Everyday Comfort for US Drivers PSER Eligibility Check 2026 by CNIC on PSER Punjab Gov Pk

PSER Eligibility Check 2026 by CNIC on PSER Punjab Gov Pk 8070 PSER Ramzan Relief 2026 – Ineligibility Reasons, Eligibility Rules & Re-Verification Process

8070 PSER Ramzan Relief 2026 – Ineligibility Reasons, Eligibility Rules & Re-Verification Process BISP 8171 Check by SMS 2026 New Registration Method and CNIC Verification Guide

BISP 8171 Check by SMS 2026 New Registration Method and CNIC Verification Guide Big News: 8070 Ramzan Relief Package 2026: How to Check Eligibility for Free Ration & 10,000 Cash.

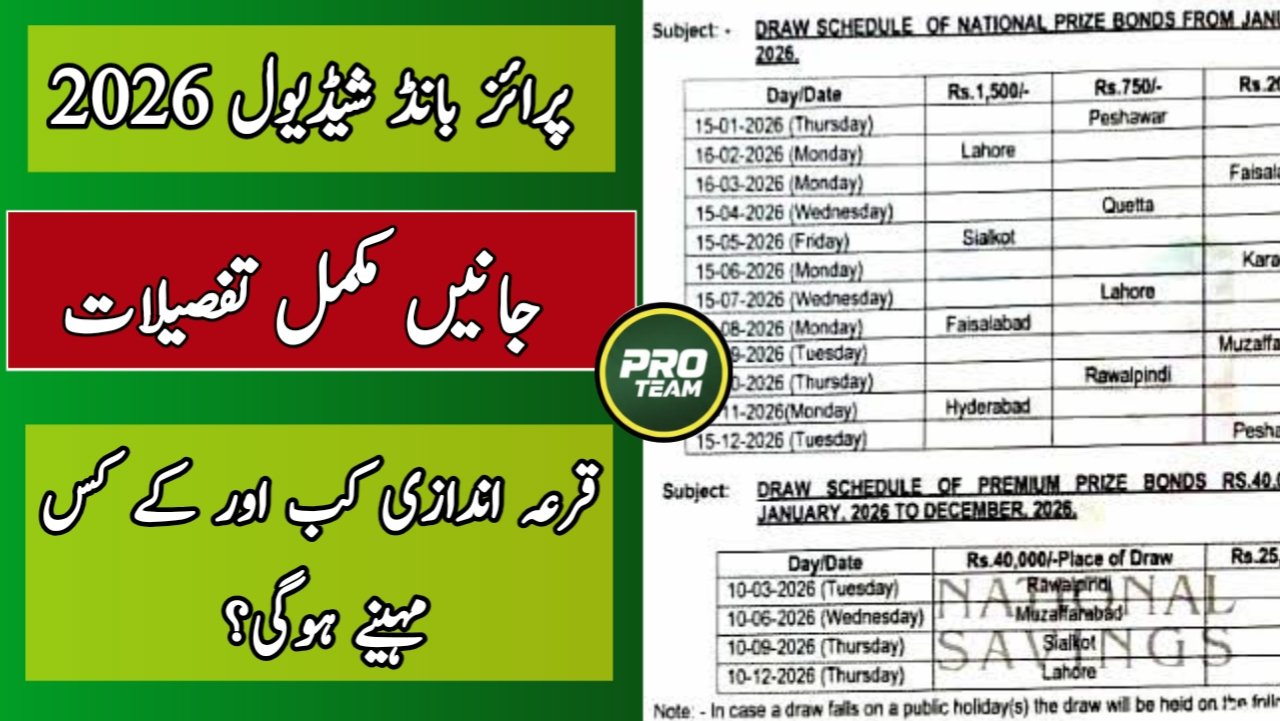

Big News: 8070 Ramzan Relief Package 2026: How to Check Eligibility for Free Ration & 10,000 Cash. Breaking News: Prize Bond Draw Schedule 2026 – Complete Guide for All Denominations

Breaking News: Prize Bond Draw Schedule 2026 – Complete Guide for All Denominations