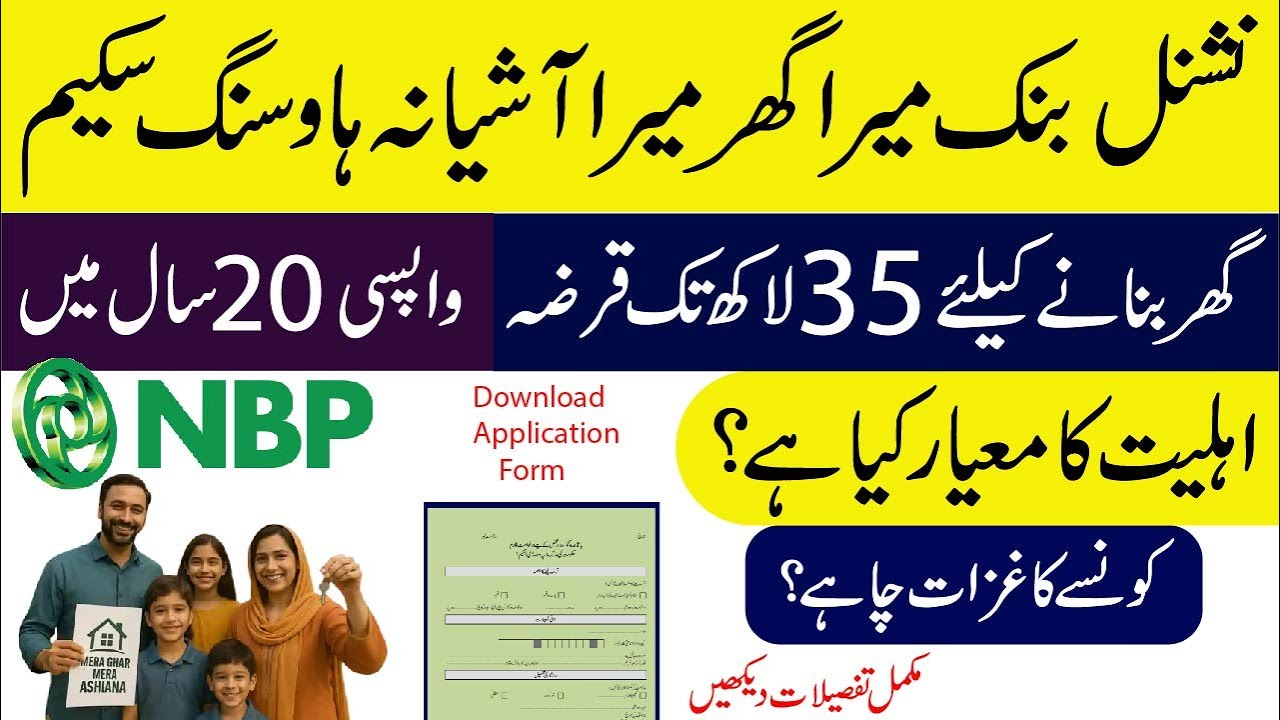

Good News: NBP Mera Ghar Mera Ashiana Scheme 2025 – Apply Online & Download Housing Loan Form

NBP Mera Ghar Mera Ashiana Scheme

Owning a home is one of life’s biggest dreams, and the National Bank of Pakistan (NBP) is making that dream achievable again with the NBP Mera Ghar Mera Ashiana Scheme 2025. This initiative aims to provide affordable home financing to Pakistan’s low- and middle-income families through low markup rates, flexible repayment options, and simplified procedures.If you’re planning to build, purchase, or renovate a home, this program offers an excellent opportunity to do so under government-subsidized financing in collaboration with the State Bank of Pakistan (SBP).

What is the NBP Mera Ghar Mera Ashiana Scheme 2025?

The NBP Mera Ghar Mera Ashiana Scheme 2025 is a government-backed home financing project designed to make housing more accessible for Pakistan’s working class. Under the Mark-Up Subsidy Program (MUSP), the government offers reduced markup rates to help citizens buy or build homes on easy monthly installments.This scheme particularly supports first-time homeowners, ensuring that people from all income groups — especially those who struggle to get commercial loans — can now own property with confidence and financial ease.

Key Features of the NBP Housing Loan Scheme 2025

- Low Markup Rates: Starting from 3% to 7% annually, depending on the loan tier.

- Flexible Repayment Tenure: Up to 20 years to ease financial burden.

- Loan Limit: Financing up to Rs. 10 million based on category and location.

- Wide Eligibility: Available to both salaried and self-employed individuals.

- Purpose Options: Purchase, construct, or renovate a residential property.

- Quick Processing: Simplified documentation and transparent approval procedure.

NBP Housing Loan Categories 2025

| Category | Purpose | Maximum Loan Amount | Approx. Markup Rate |

| Tier 1 (T1) | Low-cost housing under NAPHDA projects | Rs. 2.7 million | 3% – 5% |

| Tier 2 (T2) | Non-NAPHDA urban housing | Rs. 6 million | 5% – 7% |

| Tier 3 (T3) | General housing for middle-income buyers | Rs. 10 million | 7% – 9% |

(Note: Markup rates and limits may vary based on SBP and government revisions in 2025.)

Eligibility Criteria for NBP Mera Ghar Mera Ashiana Loan 2025

| Requirement | Details |

| Nationality | Must be a Pakistani citizen with a valid CNIC |

| Age Limit | 25–60 years for salaried; up to 65 years for self-employed |

| Income Limit | Up to Rs. 200,000 (Tier 1) and Rs. 500,000 (Tier 2) |

| Home Ownership | First-time homeowner (no existing house) |

| Credit History | Must have a clean record with no loan defaults |

| Employment Type | Salaried, self-employed, or informal income earners |

Documents Required for Application

Before applying, prepare the following documents to ensure smooth processing:

- Copy of CNIC (applicant & co-applicant, if applicable)

- Income proof (salary slips or business records for last 3 months)

- Bank statement for past 6 months

- Property documents or approved site plan

- Utility bills for address verification

- Two passport-size photographs

How to Apply Online for NBP Mera Ghar Mera Ashiana Scheme 2025

Follow these steps to apply easily:

- Visit the official NBP website and download the loan application form (PDF).

- Provide your personal data, CNIC, contact info, income details, employment type, and property information accurately.

- Attach all the required documents including CNIC copies, proof of income, and property papers.

- Visit your nearest NBP branch and submit the completed form to the Housing Finance Officer.

- NBP will verify the submitted documents, inspect the property, and upon approval, release funds as per scheme guidelines.

NBP Installment Calculator 2025 (Estimated)

| Loan Amount (PKR) | Tenure (Years) | Markup Rate | Approx. Monthly Installment |

| 2,000,000 | 10 | 3% | Rs. 19,000 |

| 4,000,000 | 15 | 5% | Rs. 32,000 |

| 8,000,000 | 20 | 7% | Rs. 50,000 |

(Actual installment may vary depending on the final approval and updated interest rates.)

Benefits of Choosing NBP for Your Home Loan

- Available across 1,500+ branches nationwide

- SBP-regulated and government-backed

- Subsidized markup rates for eligible applicants

- Quick approval and transparent disbursement process

- No hidden fees or third-party agent

NBP Customer Support for Housing Loan Queries

| Contact Method | Details |

| Helpline | 021-111-627-627 |

| housing.finance@nbp.com.pk | |

| Website | www.nbp.com.pk |

| Address | NBP Head Office, I.I. Chundrigar Road, Karachi |

Government’s Vision Behind the Scheme

The Government of Pakistan aims to bridge the housing gap by supporting affordable homeownership. Through NBP’s Mera Ghar Mera Ashiana initiative, the government targets the construction and financing of over 500,000 homes by 2026, boosting job creation and promoting economic growth.NBP plays a pivotal role in executing this vision by ensuring transparency, accessibility, and affordability for every eligible Pakistani.

Frequently Asked Questions (FAQs)

1. Who is eligible to apply for the NBP Mera Ghar Mera Ashiana Scheme?

Both salaried and self-employed Pakistani citizens aged 25–60 years, with no prior home ownership and a stable income, can apply.

2. What is the maximum loan amount available under this scheme?

You can apply for financing up to Rs. 10 million, depending on your income and property category.

3. How long does it take for loan approval?

Loan processing typically takes 2–4 weeks, depending on document verification and property evaluation.

Final Word

The NBP Mera Ghar Mera Ashiana Scheme 2025 is a golden opportunity for every Pakistani dreaming of a home. With low markup rates, easy installments, and government support, it’s the ideal time to take your first step toward owning your dream house.Apply today through your nearest NBP branch or online portal — and make your “Mera Ghar” a reality in 2025.

Latest Updates

Big Update: NADRA Smart ID Card 2026 – New Fees and Fast-Track Delivery

Big Update: NADRA Smart ID Card 2026 – New Fees and Fast-Track Delivery News Alert: How to Check CM Punjab Honhar Laptop Scheme Phase 2 Merit List Online

News Alert: How to Check CM Punjab Honhar Laptop Scheme Phase 2 Merit List Online Latest News: Multan Sultans Sold for Record Rs 2.45 Billion Ahead of PSL 11

Latest News: Multan Sultans Sold for Record Rs 2.45 Billion Ahead of PSL 11 Breaking News: Ramzan Negahban Card 2026 Online Registration Through PSER for Rs 10,000 Cash

Breaking News: Ramzan Negahban Card 2026 Online Registration Through PSER for Rs 10,000 Cash Latest Update: Chief Minister Livestock Card 2026 for Farmers Interest Free Loans and Animal Feed New Update

Latest Update: Chief Minister Livestock Card 2026 for Farmers Interest Free Loans and Animal Feed New Update Breaking News: DWP Announces New Housing Rules for UK Pensioners – Big Changes Begin 10th February 2026

Breaking News: DWP Announces New Housing Rules for UK Pensioners – Big Changes Begin 10th February 2026