ATM Cash Withdrawal Tax Pakistan 2025 – New Rate, Daily Limit & Full Details

The Government of Pakistan has made new changes to the ATM Cash Withdrawal Tax 2025. These changes are meant to increase tax collection and encourage people to use digital banking instead of large cash transactions. The new rules apply to both tax filers and non-filers, and will come into effect from July 1, 2025.

If you often withdraw money from ATMs or banks, it is important to understand how these changes affect you.

| Point | Details (FY 2025–26) |

| Tax-Free Daily Withdrawal | Up to Rs. 75,000 (non-filers) |

| Tax Rate for Non-Filers | 1.2% on withdrawals above Rs. 75,000 |

| Tax Rate for Filers | 0.3% on withdrawals above Rs. 50,000 |

| Previous Rate (Non-Filers) | 0.6% before 2025 |

| Applies To | ATM, bank branch, and cash withdrawal through credit cards |

| Effective Date | July 1, 2025 |

| Monitoring Authority | Federal Board of Revenue (FBR) |

| Purpose | Promote digital banking and expand tax net |

Why the ATM Withdrawal Tax Exists

The ATM Cash Withdrawal Tax was first introduced to track money that is not recorded in the system. Many people in Pakistan still use cash for daily transactions instead of online banking or card payments.

The main goals of this tax are to:

- Encourage more people to file income tax returns.

- Reduce cash usage and promote online transactions.

- Help the FBR track unreported income.

- Increase the government’s revenue without new indirect taxes.

New Changes in ATM Cash Withdrawal Tax 2025

The 2025 federal budget has introduced some important updates to this tax policy:

- Higher Tax for Non-Filers:

Non-filers will now pay 1.2% tax on daily cash withdrawals above Rs. 75,000. Earlier, the rate was only 0.6%. - Increase in Daily Limit:

The limit has increased from Rs. 50,000 to Rs. 75,000, giving small account holders relief. - Tax for Filers:

Even filers now pay 0.3% tax on withdrawals above Rs. 50,000 in a single day. - Automatic Tax Deduction:

Banks will automatically deduct tax from your account at the time of withdrawal. - FBR Monitoring:

The FBR will link withdrawal records with CNIC and tax files to catch non-compliant individuals.

Example Scenarios for ATM Tax 2025

Here are a few simple examples to understand how much tax you will pay:

- Example 1 (Filer):

If you withdraw Rs. 60,000 in one day → Tax = 0.3% = Rs. 180 deducted - Example 2 (Non-Filer):

If you withdraw Rs. 100,000 in one day → Tax = 1.2% = Rs. 1,200 deducted - Example 3 (Small Withdrawals):

If you withdraw Rs. 40,000 in one day → No tax applies (under limit).

How to Reduce Your ATM Tax Burden

You can easily reduce or even avoid paying high ATM taxes by following a few smart financial steps:

- Become a Tax Filer: Register with FBR and file your annual income tax return to enjoy a much lower tax rate.

- Use Digital Payments: Try paying with debit cards, mobile banking apps, or online transfers instead of cash.

- Plan Withdrawals: Withdraw smaller amounts across different days to stay below the daily limit.

- Check Your Bank Statements: Make sure the deducted tax matches your actual withdrawals.

Purpose of the 2025 Tax Policy

The government has introduced this policy not just to collect more revenue but to encourage responsible financial habits among citizens.

The main purposes include:

- Widening the tax net by targeting non-filers.

- Promoting digital banking instead of cash transactions.

- Improving transparency in financial dealings.

- Encouraging accountability among high-cash users.

Conclusion

The ATM Cash Withdrawal Tax 2025 is a key part of Pakistan’s financial reforms. It encourages citizens to become tax filers and shift toward a digital economy. While non-filers will now face a 1.2% tax on large withdrawals, filers pay only 0.3%.

To avoid extra costs, Pakistanis are advised to file taxes, plan withdrawals smartly, and use digital banking methods. This not only saves money but also helps the country move toward a transparent financial system.

FAQs

Q1: Who will be affected by the new ATM tax rules in 2025?

All bank account holders in Pakistan — both filers and non-filers — will be affected if they withdraw cash above the set limits.

Q2: How can I avoid paying high ATM tax?

You can avoid high taxes by becoming a filer, using digital banking, and keeping your withdrawals under Rs. 75,000 per day.

Q3: Will the tax apply if I withdraw money from a bank counter?

Yes. The withholding tax applies to ATM withdrawals, bank counter withdrawals, and cash advances from credit cards.

Q4: Where can I check official ATM tax details?

You can visit the FBR Official Website for updates and complete tax guidelines.

Latest Updates

BISP 8171 Check by SMS 2026 New Registration Method and CNIC Verification Guide

BISP 8171 Check by SMS 2026 New Registration Method and CNIC Verification Guide Big News: 8070 Ramzan Relief Package 2026: How to Check Eligibility for Free Ration & 10,000 Cash.

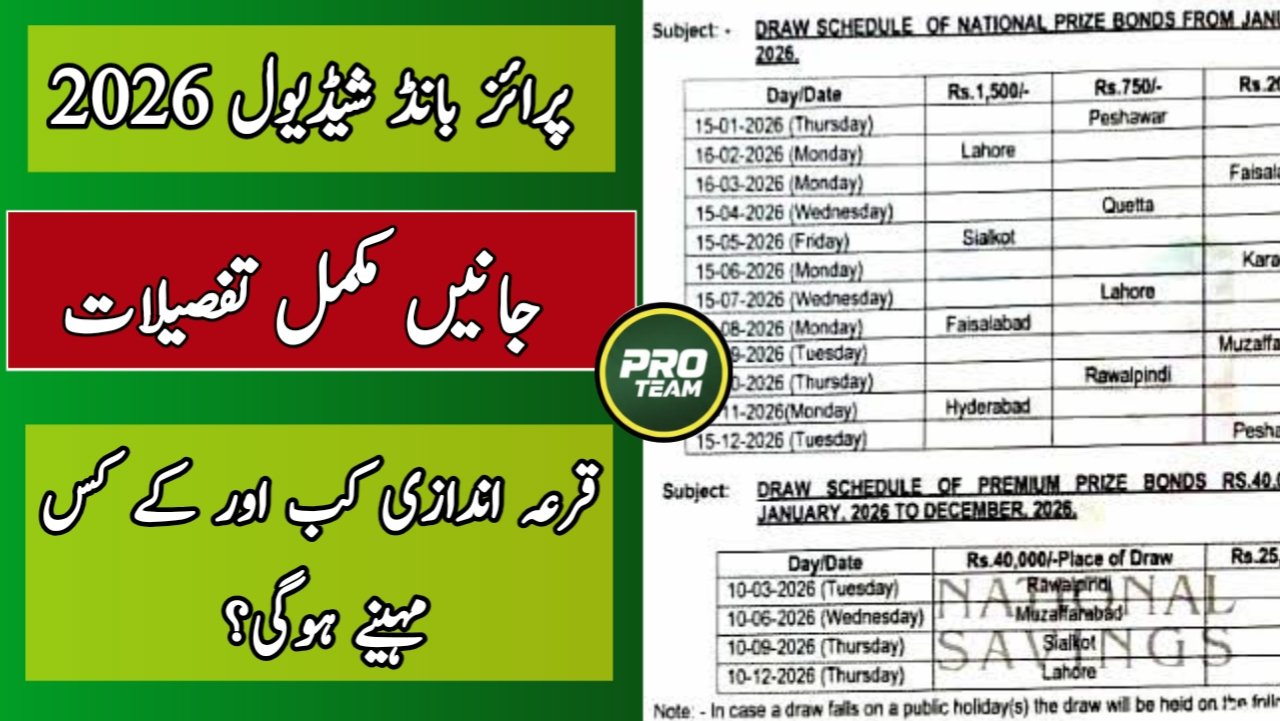

Big News: 8070 Ramzan Relief Package 2026: How to Check Eligibility for Free Ration & 10,000 Cash. Breaking News: Prize Bond Draw Schedule 2026 – Complete Guide for All Denominations

Breaking News: Prize Bond Draw Schedule 2026 – Complete Guide for All Denominations Breaking: Punjab Government Ramadan 2026 Preparations: Bazaars, Facilitation Centers & 8070 PSER Registration

Breaking: Punjab Government Ramadan 2026 Preparations: Bazaars, Facilitation Centers & 8070 PSER Registration Big Update: NADRA Smart ID Card 2026 – New Fees and Fast-Track Delivery

Big Update: NADRA Smart ID Card 2026 – New Fees and Fast-Track Delivery News Alert: How to Check CM Punjab Honhar Laptop Scheme Phase 2 Merit List Online

News Alert: How to Check CM Punjab Honhar Laptop Scheme Phase 2 Merit List Online